Unichain's Crypto Airdrop: Boosting UNI's Value Through Innovative Liquidity Mining

4/18/2025

Since the launch of Unichain, optimized for DeFi, its Unichain Validation Network (UVN) has received significant market attention. The core mechanism of UVN is to allocate 65% of network revenue to validators and stakers, giving the UNI token vital functionality. For a long time, UNI has been criticized for its weak value capture ability, but the launch of UVN is expected to markedly enhance its value potential. However, for a chain to generate revenue, it needs transactions, and for transactions to occur, it must attract capital. Therefore, the first step is to attract Total Value Locked (TVL) through liquidity mining.

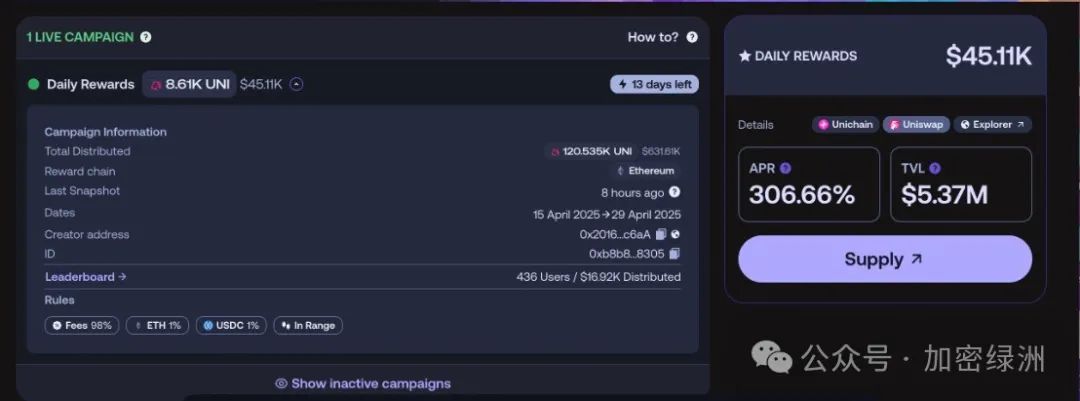

On April 15, Unichain launched a two-week liquidity mining activity, distributing $5 million worth of UNI tokens across 12 LP pools. The rewards will update every six hours, and users do not need to stake LP tokens additionally. Gauntlet, a protocol for Web3 risk management and incentive optimization, is responsible for the event's design, optimization, and analysis, while Merkl (app.merkl.xyz) handles the distribution and calculation of rewards. Notably, during the Unichain event, Merkl adopted a parameterized configuration similar to the Uniswap Arbitrum activity, with 98/1/1 parameters, meaning that 98% of the rewards are based on LP-generated transaction fees, 1% based on the quantity of Token A, and 1% based on the quantity of Token B. This configuration incentivizes LPs to actively manage liquidity and optimize price execution efficiency.

Below is a simplified participation guide:

Preparation:

- Wallet: Use a wallet that supports the Unichain network (such as MetaMask or Uniswap Wallet), and ensure that you have added the Unichain network (https://chainlist.org/?search=unichain).

- Assets: Prepare tokens to participate in the pools (such as USDC, ETH, etc.) and a small amount of ETH for gas fees.

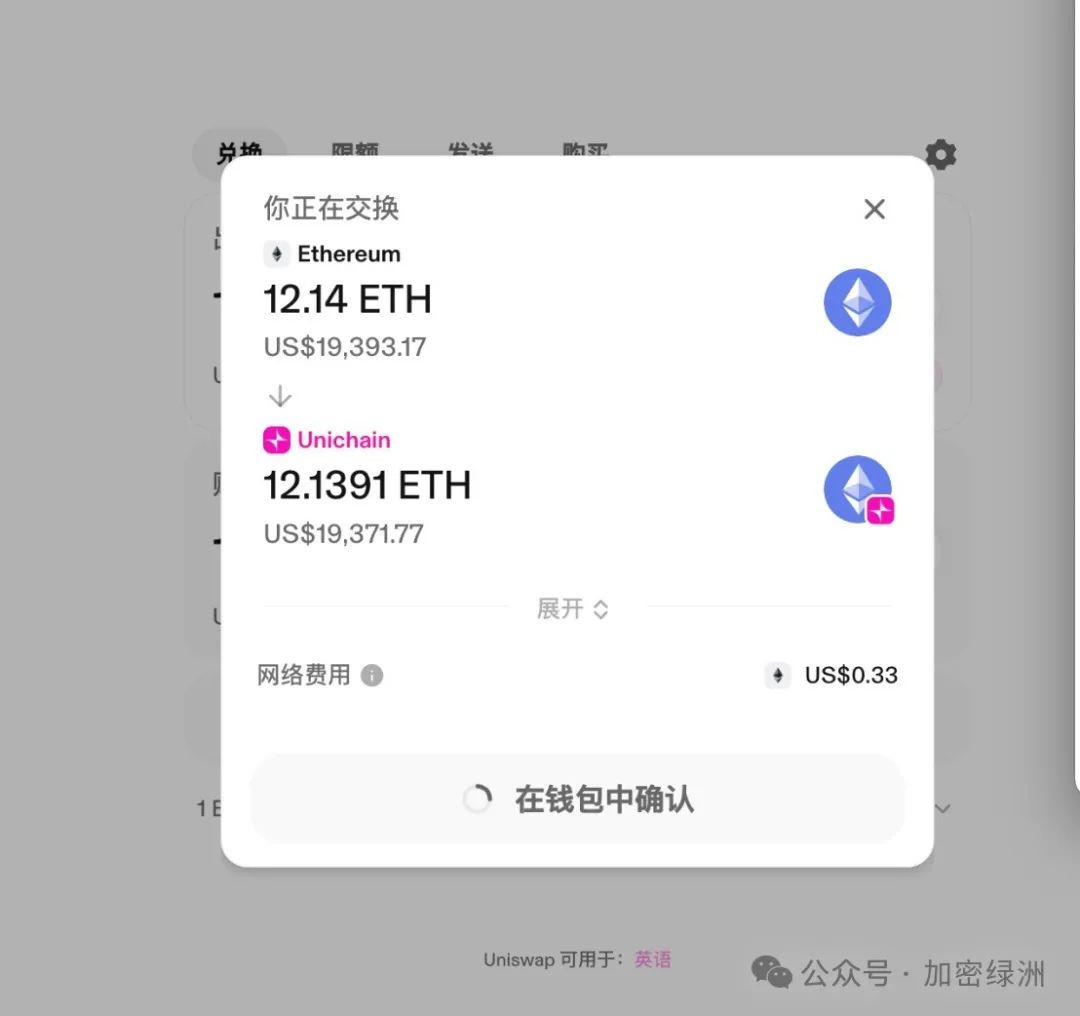

- Cross-chain Bridge: Bridge assets from Ethereum mainnet or other chains (such as Optimism, Base) to Unichain using the official Unichain cross-chain bridge (bridge.unichain.org).

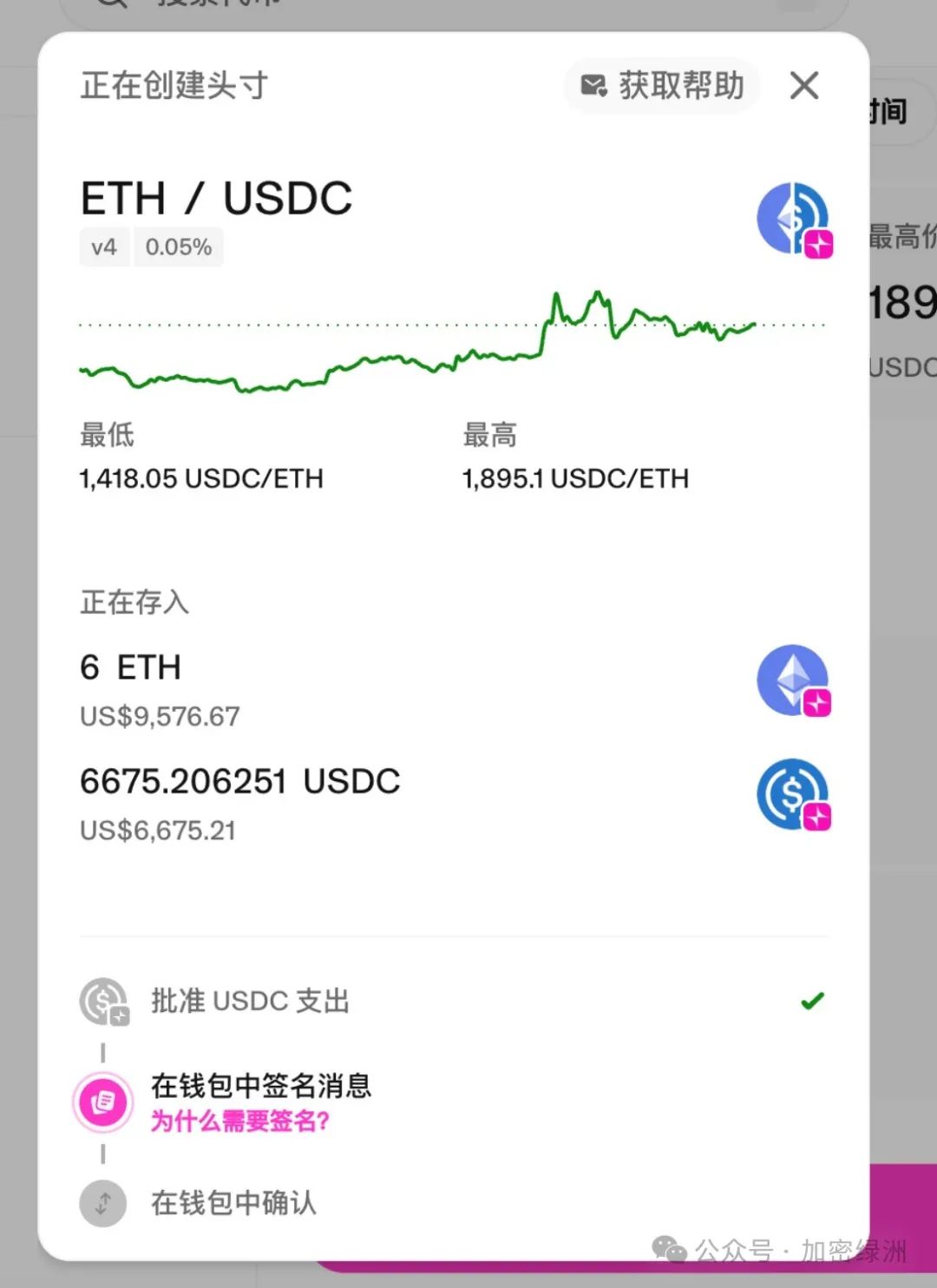

Add Liquidity:

Visit the Uniswap interface (app.uniswap.org) and switch to the Unichain network. Select the "Pool" option and find your target liquidity pool (such as USDC/ETH). Enter the amount of tokens and set the price range (it is recommended to refer to the data dashboard for high liquidity ranges). Confirm the transaction, pay the gas fee, and complete the addition of liquidity.

Monitor and Claim Rewards:

Rewards are issued every six hours and can be viewed on the Uniswap interface or app.merkl.xyz. Regularly check the status of the pools and adjust the price ranges to ensure you're "in-range" for maximum yield. After the event concludes, rewards will either be automatically allocated to your wallet or require manual claiming (specific details will follow official guidelines).

Finally, it is worth noting that three of the twelve pools are paired with USDT0. Here’s a brief introduction to USDT0. USDT0 is a cross-chain stablecoin based on the LayerZero Omnichain Fungible Token (OFT) standard launched by Tether, designed to circulate on blockchains that do not natively issue USDT while maintaining a 1:1 value peg to USDT. It operates through a lock-and-mint mechanism: USDT is locked on the Ethereum mainnet, and a corresponding amount of USDT0 is minted on the target chain (such as Unichain, KrakenInk, Arbitrum, Berachain, etc.), ensuring that each USDT0 has equivalent USDT backing. USDT0 is managed by Everdawn Labs.

Thus, please be cautious when pairing. This concludes the introduction to Unichain's liquidity mining activity.

Our awesome Tutorials

Understanding Crypto Airdrop: Transparency in Cryptocurrency Wallets

This article explores the public nature of cryptocurrency wallets and how wallet addresses function similarly to bank account numbers.

Top 10 Innovative DePIN Projects for a Crypto Airdrop Revolution

Explore the revolutionary DePIN projects shaping the future of decentralized infrastructures in the digital economy.

Discover LOOP SPACE: A New Social Platform with Crypto Airdrop Opportunities

LEARN ABOUT LOOP SPACE, an AI-driven social platform that allows users to interact, gift, and manage cryptocurrency assets.

Introducing xU3O8: A Unique Crypto Airdrop Opportunity

Explore xU3O8, a tokenized uranium solution allowing users to invest in physical uranium with transparency and ease. Discover its unique features and how to participate.

Unichain's Crypto Airdrop: Boosting UNI's Value Through Innovative Liquidity Mining

Unichain has launched a two-week liquidity mining event, distributing $5 million worth of UNI tokens, enhancing its value proposition through strategic mechanisms.

Hana Network's $6 Million Crypto Airdrop and Future Prospects

Hana Network has secured $6 million in funding, planning major developments including a significant crypto airdrop.

Monad: The Game-Changing Crypto Airdrop for Next-Gen Blockchain

This article explores Monad, a high-performance layer 1 blockchain aimed at transforming the crypto landscape by enhancing DeFi, NFTs, value storage, and international payments.

Crypto Airdrop Opportunity: Explore the Infinex Project

This article explores the Infinex project, its interactions, and the potential for airdrop opportunities.

Botanix Lab Spiderchain Testnet Airdrop Guide

Botanix Lab needs no introduction as it's everywhere. This is the final testnet before mainnet launch, which is expected in Q1 2025. Here's a detailed guide for the basic tasks: